Ensuring that New Zealand doesn’t miss out

New Zealand represents one of the most opportunistic markets for Build to Rent (BTR) investors in the world but, according to JLL’s latest Global research whitepaper ‘Growth opportunities in living’, it is being significantly held back by its high barriers to entry.

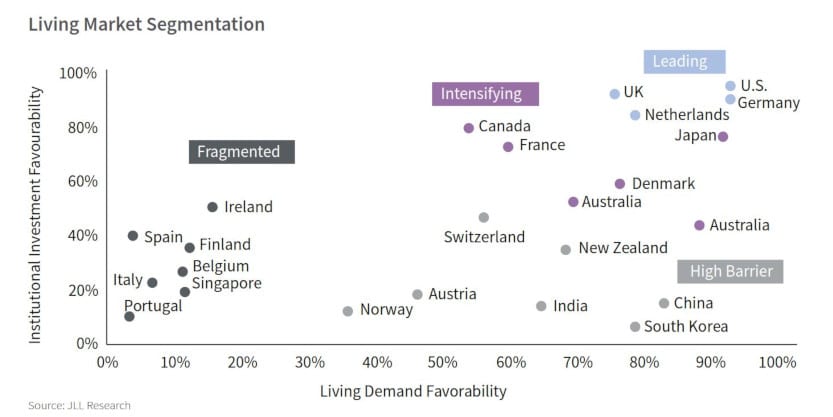

JLL has compared 24 Global investment opportunities in the Living Sector, with the global opportunity map making interesting reading for our country.

- Alongside China, India and South Korea, New Zealand boasts tremendous upside potential due to strong demographics and economic performance; BUT

- Central governments dictating housing policy, including regulations regarding who can own and operate assets, is disrupting the market entry opportunity for experienced living owners, operators, and developers.

New Zealand is within touching distance of benefitting from substantial investment from the global living market, which is one of the two fastest growing major investment sectors in the world.

Shifting capital allocations are favouring the living sector. Supply-demand imbalances, as well as an increasing number of transactions and liquidity are supporting the long-term investment thesis. Living investments also provide investment diversification benefits through cover upturns and down turns.

There is no doubt that BTR is an exciting sector for investors, with growth opportunities significant and quickly evolving. But, the biggest winners in New Zealand were we to attract BTR investment and development could well be prospective renters. This is a real opportunity to raise the bar for rental accommodation in New Zealand to the benefit of renters.

Since returning to New Zealand permanently in 2018, I have consistently promoted the benefits that BTR could offer renters throughout New Zealand. Personally and professionally, I am passionate about BTR primarily because I gained a great deal of experience working in the sector in the UK during its development between 2008 and 2018.

I saw first-hand the real difference that can be made to the renter experience when people live in professionally managed, customer driven, and community focused living environments. Yet, while we are starting to see great progress with a small number of pioneering investors and developers delivering quality long-term rental offerings, BTR schemes in New Zealand are not prevalent enough to make a real difference to most who live in the rental market. And critically, JLL’s research (carried out by our global research team from London and New York) has highlighted the challenges that New Zealand needs to overcome to deliver BTR at scale.

It is paramount that we address these roadblocks to avoid the danger of missing the BTR boat in New Zealand altogether.

The main thing holding us back is high barriers to entry – but crucially those high barriers are wholly at the discretion of the Government to lower. They are not insurmountable, but they do require Government leadership and action to be overcome.

Thankfully, the requests of the Government are relatively moderate to make BTR a reality in New Zealand. To kickstart the sector we need policy settings that enable:

- International liquidity: Through changes to the Overseas Investment Act’s treatment of BTR as a residential asset class

- A commercial approach to investment: No restrictions on interest deductibility for taxation calculations

- Depreciation relief for tax purposes: The same as for commercial buildings to reflect that buildings age and need to be maintained

- Encourage BTR operators to offer renters flexibility: in tenancy length and notice periods to leave, but with certainty of tenure through commitments to rent to occupiers, renters or tenants for the long term.

Minor tweaks to the payment timings of GST through the construction period and the practicalities of the Residential Tenancies Act would also be helpful. The next few weeks for BTR in New Zealand represent a crunch-time with the Government’s commitment to an announcement regarding sector support in November.

Will they support BTR and allow the private sector to deliver the new additional rental homes at scale if policy settings enabled viability? Or will they not?

This doesn’t feel like it should be a difficult decision given the need increased investment for more housing, high quality living accommodation, and a better deal for renters.

BTR can clearly be a significant part of the solution for some of New Zealand’s housing problems, and we need to take advantage of it now; the asset class’s global growth phase won’t last forever.

Growth opportunities in living

JLL has recently released their 'Growth Opportunities in Living' Report, where they identify the most dynamic global markets and the key demand drivers to inform future investment strategies.

Over the past decade, the expansion of living as an institutional investment sector has broadened from a few established markets in advanced economies, to many markets globally. With portfolio diversification accelerating and strong capital inflows, competition for living product has increased markedly in recent years and the pandemic has only amplified this focus.

By 2030, JLL anticipates one-third of all global direct investment into real estate will occur in the living sector.

Favorable demographic and economic tailwinds are driving expansion in established markets and accelerating growth in emerging and new markets. For-rent housing has the unique opportunity to address affordability challenges, evolve with shifting demographics and provide compelling risk-adjusted returns to investors and developers.

To better understand the global landscape of opportunity in this dynamic sector, JLL has developed a framework to assess market maturity and momentum across 24 of the largest and most promising for-rent housing markets globally.

Download the ReportAUTHOR

Paul Winstanley

Head of Build to Rent, Australia and NZ and Head of Research & Consultancy, NZ // JLL

Head of Research and Consultancy, New Zealand in JLL’s research team, based in Auckland, New Zealand. Paul has been appointed to lead a specialist JLL Australasia BTR team that has been strategically built to provide an ‘end-to-end’ service including extensive market research, consulting, valuation and exceptional execution specialisation throughout New Zealand and Australia.