According to RLB’s Oceania Report, Auckland remained at the forefront of construction activity across NZ’s regions. The value of construction work increased in Auckland and, to a lesser extent, in Waikato. This contrasts with other regions, such as Wellington and Canterbury, where construction activity contracted.

New construction work in Auckland fuelled by migration

Auckland now accounts for approximately 41% of nationwide construction activity (on a nominal basis). This concentration of new construction work in Auckland is largely driven by the region’s strong population growth, which has been fuelled by migration.

Weak residential construction demand has been broad-based across the regions. The decline has been particularly marked in Auckland, following very strong growth in the region in 2021 and 2022. Annual Auckland dwelling consent issuance fell to just under 15,500 for the year to December 2023. This represents a 27% decrease compared to the same time in 2022.

Higher interest rates forecast to dampen construction demand

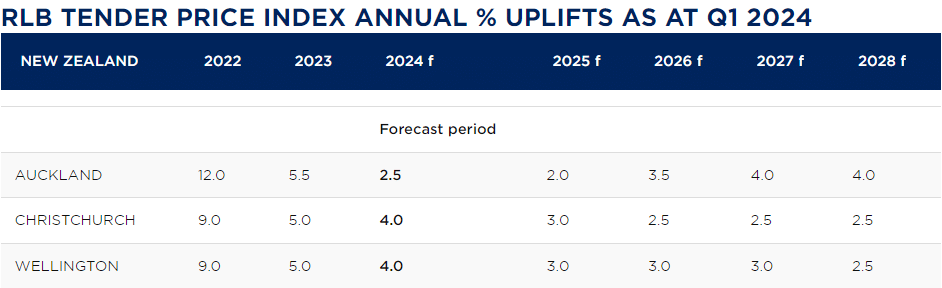

RLB anticipates that higher interest rates and restricted access to finance will continue to suppress residential construction demand over the next 12 months.

However, strong migration-led population growth will support residential construction demand from 2025. This upturn will likely be spurred by a recovery in house prices, encouraging property developers to introduce new housing to the market. Other construction indicators also point to a weak near-term pipeline of construction activity.

Decline in construction activity in Auckland

Broader economic conditions are affecting construction demand in the Auckland region, leading to a noticeable decline in construction activity.

Despite record levels of immigration, the high interest rate environment has significantly curtailed both residential and non-residential development. Additionally, the new government’s fiscal restraint is expected to make 2024 and 2025 challenging years for the construction industry.

Decrease in residential construction in Christchurch

In Christchurch, trade pricing is stabilising due to heightened competition, which could lead to more predictable project costs. Residential construction activity has slowed in recent months, indicating a potential downturn in this sector.

A significant ongoing school program has been paused under the new government, delaying educational infrastructure developments. Variations in trade pricing for large and complex projects reflect differing risk assessments and the clarity of future workload, affecting project budgeting and planning.

While large pipelines of infrastructure work are expected nationally in the coming years, there is uncertainty about the scale of these projects in various regions, which may lead to uneven development and investment.

Wellington experiencing strong demand with major challenges

Wellington’s construction market presents a complex picture, with positive trends offset by several challenges.

The city is experiencing significant demand for construction services, fuelled by infrastructure projects and residential development, such as the regeneration of Te Aro.

However, labour shortages persist as a major obstacle, with the industry facing difficulties in finding and retaining skilled workers – a problem that is not unique to Wellington but prevalent nationwide.

In addition, supply chain issues and rising labour costs are placing pressure on builders and developers, which could lead to project delays and increased costs.