Kiwi Property’s David Schwartfeger, Development Director – Drury, provides an overview of the forces impacting Auckland’s housing market.

Whilst we have seen a cooling of the housing market in Auckland over the last 12 months, this won’t last forever, and housing supply issues are likely to be further exacerbated post Cyclone Gabrielle.

The Auckland Plan 2050 (Auckland Council spatial plan) provides that a minimum of 408,300 new homes will be created to respond to growth demands up to 2050. The focus of the new homes is primarily on in-fill or ‘brownfields’ development, with a strong emphasis on a ‘quality compact city’ approach. But Council may have to take a careful review of this approach given the 4,000 land damage claims and 50,000 insurance claims lodged because of cyclone Gabrielle.

The large number of claims have created immediate housing issues at a time where there is a limited supply of houses. In the longer-term, the effects of cyclone Gabrielle may be more severe when Council has a better understanding around the condition of its aging infrastructure and the cost of infrastructure upgrades to service the proposed intensification.

Demand is coming back

Auckland’s rapid population growth over the last decade, driven by factors such as migration, natural population growth and increased urbanization has seen the super-city’s population grow to over 1.7 million people and expected to hit 2.5 million over the next 30 years. Under the Auckland Plan 2050 a minimum target of 408,300 new dwellings has been set to provide sufficient feasible development capacity to house these new families (approx. 13,610 new dwellings per year).

The changing demographics and diverse population have varying housings requirements (e.g. an ageing population, increasing need for single person housing and multi-generational housing and a clear need to address the plight of the housing for the homeless).

Fortunately, in the last two years, migration has been very subdued with net migration being negative from April 2021 to October 2022 due to Covid-19 boarder restrictions. That said, the borders have now reopened, and annual immigration numbers have exceeded 50,000 people per annum and all forms of housing are likely to come under additional pressure.

Supply side issues

Housing supply is a complex issue influenced by various factors such as geographical constraints, regulatory and planning framework, environmental consideration, demand for land from other sectors and availability of serviced land.

First and foremost, Auckland has significant geographic constraints, such as a narrow isthmus, volcanic cones, productive soils and limited land suitable for housing development.

Over the last decade Central Government has tried to increase land supply by driving policy changes such as the Auckland Unitary Plan (2012), Special Housing Areas (2013), and more recently Covid-19 Fast track Legislation (2020), NPS -UD and Resource Management Act Enabling Housing Supply Act (2020/21).

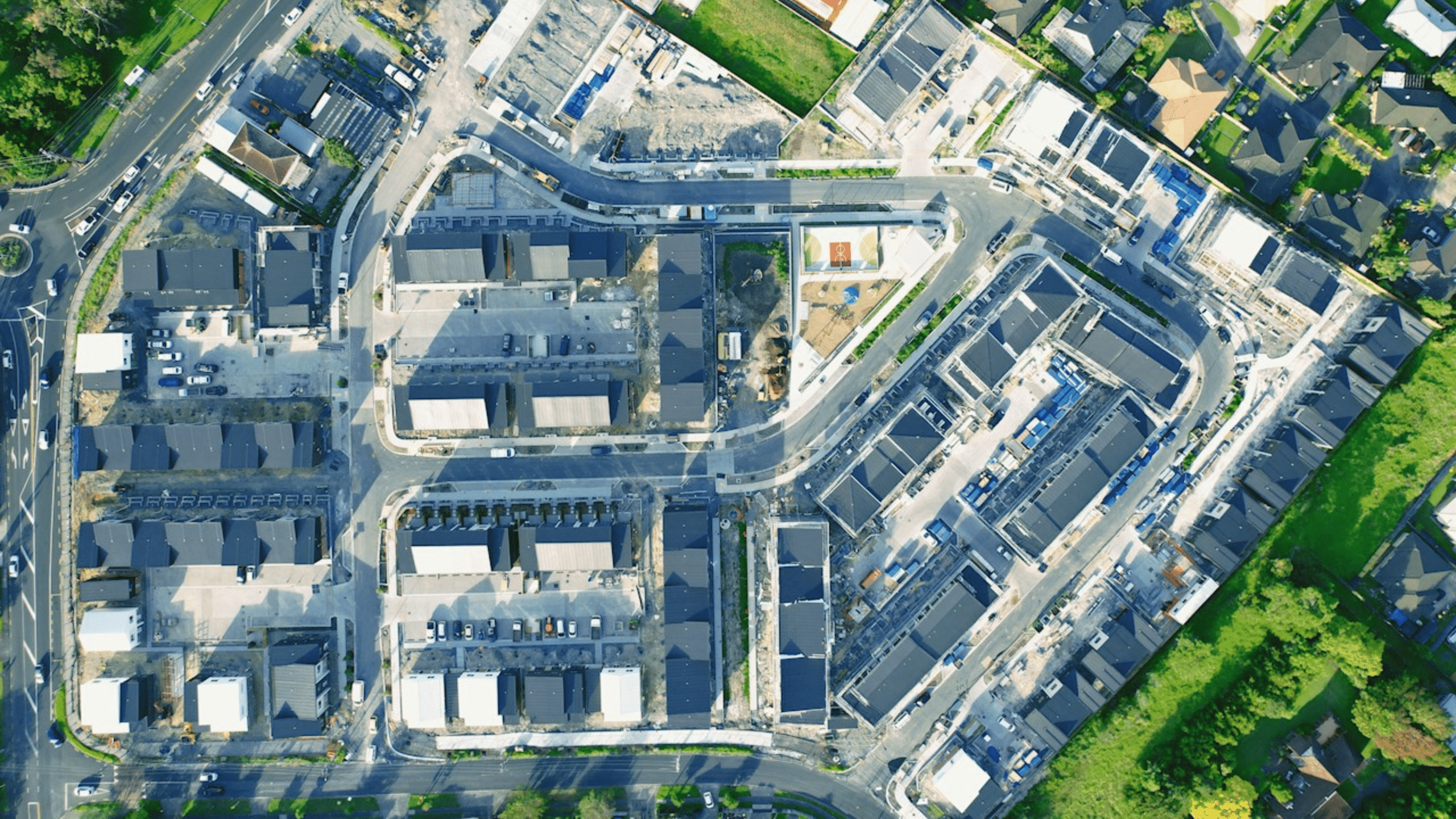

In parallel, the Crown has taken an active role in undertaking developments (e.g. Hobsonville, Glen Innes Panmure, Mt Roskill, Northcote Point, Mangere, Unitec) and declared a number of blocks of land surplus under the Crown Land Release Programme.

At a more local level, Council has approved new Structure Plans for Drury-Opaheke, Whenuapai, Pukekohe-Paerata and Warkworth, but have only managed to lodge one Council led residential Plan Change (Plan Change 5) since the Auckland Unitary Plan was created.

The Auckland Plan 2050 looks to support a range of both brown and greenfield housing options with a strong emphasis on Compact Urban Form and Intensification around existing centres. Around 62% of the development supply is anticipated to be provided from existing urban areas with the remaining development anticipated to occur in future urban and rural areas to provide a combined total of 13,610 of new homes required.

By comparison, completed dwellings for the last three years have been 12,040 (2020) 13,470 (2021) and 13,865 (2022) which generally sounds ok when compared to the 13,610 required by the Auckland Plan 2020, however when you consider natural obsolescence on the estimated 600,000 homes in Auckland (say 6,000 homes per annum) coupled with those damaged by cyclone Gabrielle; supply looks well below where it needs to be to keep pace with demand.

Looking forward, we are not seeing any significant reduction in the cost of construction, development contributions are proposed to increase, and capital for funding development is difficult to obtain in a market where property prices have clearly cooled. We would speculate that several developments will be shelved in the short to medium term, and this will further exacerbate supply.

All families must have an opportunity to succeed

The demand-supply imbalance in Auckland’s housing market has had several negative consequences. One of the main impacts is the rising cost of housing, which has led to affordability challenges for many Aucklanders. The increasing cost of housing has also led to overcrowding, with multiple families or individuals sharing homes to cope with the rising costs. This has put pressure on the rental market, resulting in increased rents and reduce rental affordability. As a result, many families, including low-income households, have faced housing stress, housing insecurity, and homelessness.

David Schwartfeger

Development Director, Kiwi Property