Information based on Gallagher Insurance’s (formerly known as Crombie Lockwood) Insurance Market Update May 2022, with contributions from Steven van der Pol, Corporate Business Development Manager, Crombie Lockwood and Graeme McDonald, Director and Head of Valuation Advisory Christchurch, JLL

Any commercial and industrial property owner checking their insurance programme would have noticed the steady increase in premiums in recent years. Global market forces have combined to deliver property owners a hefty price to pay for securing their property.

In this piece, Steven van der Pol of Crombie Lockwood, along with Graeme McDonald of JLL, explore the key factors driving the New Zealand insurance market, identified as:

- Climate – severe weather events are more frequent and extreme

- Covid-19 – significant direct and indirect impact on the insurance market

- Capacity – insurers review their exposure to specific risks

- Conduct and Culture – increasing focus on good governance

- Sum insured increases – increasing building costs and inflationary provisions.

Climate

It is impossible to avoid the fact that the number of severe weather events is increasing in both frequency and severity. The global insurance market has been “hard” (premiums are increasing and capacity for most types of insurance is decreasing) as insurers concentrate on reducing their level of exposure to individual risk and seeking a sustainable price.

In New Zealand flooding has been the most common weather event accounting for over 90% of losses from total claims of $358 million for natural disasters since January 2021.

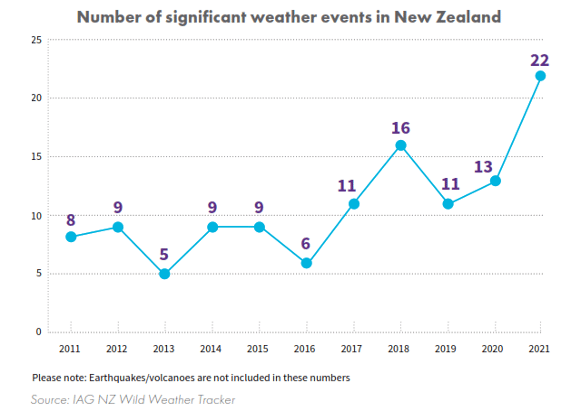

To track increasing severe weather events IAG has recently launched their” New Zealand Wild Weather Tracker” by reviewing 10 years’ claims data to identify the long-term trends in the frequency and scale of weather events including wildfires, floods, windstorms, hailstorms and heavy rain. The data showed that in 2021 there were 22 significant weather events, an increase of 275% from 2011.

Insurers are increasingly taking a more risk-based approach to assess a client’s exposure to perils such as floods and, in extreme cases, restrict cover and/or increase premiums.

The New Zealand Government has responded to severe weather events with the April 2022 publication of the draft National Adaption Plan outlining the actions it will take over the next six years in response to the priority climate-related risks identified in the 2020 National Climate Change Risk Assessment. This plan is now open for consultation.

COVID-19

The Covid-19 pandemic has significantly impacted the insurance market, both directly and indirectly. The direct cost to the insurance market of Covid-19-related claims has been estimated in the region of $70 billion, making it the third largest catastrophe loss of all time.

Direct costs worldwide relate to:

- Life and health portfolio claims.

- Business interruption claims. Whilst New Zealand policies have always contained a pandemic exclusion the Australian situation has not been so straightforward and protracted litigation continues around policy coverage.

- Travel insurance claims.

Indirect costs to claims related to economic spin-offs, notably:

- High inflation.

- Supply chain disruption.

- Building costs and reinstatement time were extended due to supply chain disruption.

The impact of inflation and the disrupted supply chain combined with the increased frequency of losses is the perfect storm driving up the costs of claims and contributing to premium increases.

A concerning by-product of this situation is under-insurance if material damage and business interruption policies are not regularly updated to ensure the sum insured reflects the current building cost.

In addition to buildings plant and machinery for commercial operations needs to be carefully considered based on the cost and time to get a replacement part or new machine as well as the expertise to install (to retain warranty) for specialised equipment.

Capacity

Insurers are reviewing their portfolios to manage their exposures to individual risks around:

- Exposures in high-risk seismic regions.

- Increased scrutiny of construction material risks.

- Capacity constraints affect the liability market.

In New Zealand, a major part of this review has been around Material Damage and Business Interruption exposure in high seismic areas and in particular the Wellington region.

Inflation is compounding the situation as revaluations are increasing property sums insured significantly and insurers are only prepared to maintain existing capacity, thus requiring other insurers to cover the balance. Insurance cover is more difficult to arrange and may result in increased premiums.

Material scrutiny of construction materials risk especially around the use of:

- Expanded Polystyrene Panel (EPS).

- Aluminium Composite Panel (ACP).

Where the above is present insurers require robust risk management procedures in place.

Insurers face capacity constraints, especially concerning large limits of indemnity on risks such as directors’ and officers’ liability and professional indemnity. With an increase in litigation and higher costs of defence, insurers are mitigating exposure by sharing insurance cover between themselves, which takes more time and can lead to increased premiums.

Conduct and Culture

The insurance operating environment is changing concerning:

- A new regulatory focus on conduct and culture.

- Environmental, Social and Governance (ESG) responsibilities.

- Climate-related legislation creates obligations for directors.

A new regulatory focus on conduct and culture will change the operating environment with the impending Financial Markets (conduct of Institutions) Amendment Bill (anticipated 2023 enforcement). This Bill represents a major upheaval to the way the New Zealand insurance market is regulated. Insurance companies will now have an obligation to comply with a principle-based fair conduct regulation regime around products and pricing.

ESG responsibilities impact underwriting and risk appetite for businesses that negatively impact the climate, environment or social landscape such as:

- Thermal coal mining extraction.

- Thermal coal electrical generation.

- Weapons manufacturing.

- Tobacco or recreational products.

We anticipate that insurers’ appetite for businesses that negatively impact the climate, environment or social landscape will reduce over time.

Within the financial sector, the ‘Climate-related Disclosures and Other Matters’ Amendment Bill of October 2021 makes climate risk disclosure mandatory for large financial institutions and certain equity and debt issuers listed on the NZX. These institutions now need to disclose climate-related information about governance, risk management, strategy and metrics and targets.

Insurers will require more detail on how boards manage risks relating to environmental, social and governance reporting and also how the business addresses Covid-19 and cyber risk.

Boards need to demonstrate good conduct and culture to insurers, especially when arranging higher indemnity limits. Insurers face the challenge of how to manage their performance to deliver acceptable returns by balancing risk and premiums whilst complying with a principle of fair conduct.

Sum Insured Increases

The above risk and inflationary factors are having a notable effect as revaluations are increasing property sums insured significantly.

When it comes to the revaluation of building assets for insurance purposes, the material damage Sum Insured is based on the sum of the:

- Reinstatement Estimate.

- Reinstatement Inflationary Provision.

- Demolition Estimate.

For valuation purposes such are defined as follows:

Reinstatement Estimate

The valuation takes into account the Reinstatement Cost Estimate of the improvements, as defined by the Property Institute of New Zealand as being:

“An estimate of the cost, as at the date of valuation, including relevant fees, of replacing the asset with a new modern equivalent asset, including where appropriate the use of current equivalent technology, materials and services. This is intended for the purpose of assisting the parties to the insurance contract in negotiating insurance premiums and, unless specified elsewhere, is not based on a detailed elemental and schedule of quantities approach as would be undertaken by a quantity surveyor or costing engineer. In construction unanticipated problems often arise and actual rebuilding, repair or replacement costs”

Reinstatement Inflationary Provision

This amount is estimated based on a loss occurring on the last day of a 12-month insurance period, if appropriate.

Inflation provisions on Reinstatement and Functional Replacement estimates incorporate an allowance for the additional time required for damage inspections, demolition, preparation of new preliminary proposals and their approval by the Territorial Authority, preparation of working drawings and specifications, schedules of quantities, in addition to an estimated period of the construction contract. No allowance is made for any delay due to the need to comply with the provisions of the Resource Management Act.

Inflationary provisions are future projections, based on recent trends and are given without prejudice.

Demolition Estimate

For valuation, it is assumed that 100% of the assets have been damaged beyond repair and have no salvage value.

Unless otherwise noted the Demolition Estimate covers the cost of demolition and removal of debris of the assets described only and excludes the cost of removal and disposal of any noxious materials or removal of debris from adjoining premises unless otherwise specified.

The Demolition Estimate does not include shoring up any structures, either on the insured property, or neighbouring properties, or the removal of building contents.

Revaluation Example

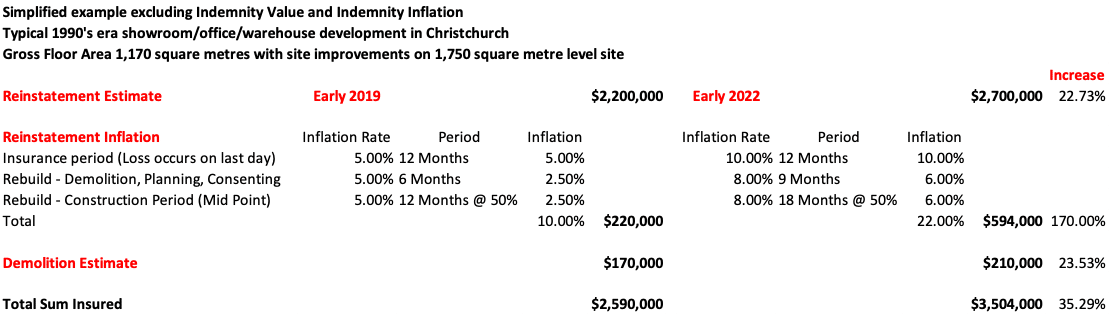

Concerning the below example, the current inflationary effects on insurance cover required over the past three years are significant (a 35.29% increase in total sum insured) concerning:

- High inflation/building cost inflation reflects increased reinstatement and demolition estimates

- An increased estimated building inflation rate over the insurance and rebuild periods

- Rebuild timeframe extended due to supply chain disruption of labour and product availability.

Principally our research is based upon construction costs sourced from our involvement with other similar assets throughout New Zealand; as well as more general market information such as construction industry building cost guides and indices.