JLL New Zealand’s latest Office Property Trends Report offers a comprehensive view of how the sector is evolving, and where the next opportunities lie for developers, investors, and property professionals.

Economic fundamentals remain strong

With office-related sectors accounting for around 30% of New Zealand’s GDP, the office market continues to be a cornerstone of the economy. Rising net migration and a growing population are expected to underpin long-term demand, reinforcing the importance of well-located and future-ready office developments.

Shifts in supply and demand

While occupier choice has increased, much of the available stock lags behind international standards. Vacancy rates are rising in CBDs, yet the strongest demand continues to centre on high-quality, well-located assets. Notably, sustainable buildings are outperforming the market—commanding higher rental premiums and achieving lower vacancy rates, as occupiers sharpen their focus on ESG performance.

Investment and capital flows

Transaction activity is stabilising, with values projected to strengthen as inflation eases and cash rates fall. Local capital remains the dominant force, but international investors—particularly in Auckland—are taking greater interest in New Zealand’s office sector, seeking long-term plays in a market with robust fundamentals.

Where the next opportunities lie

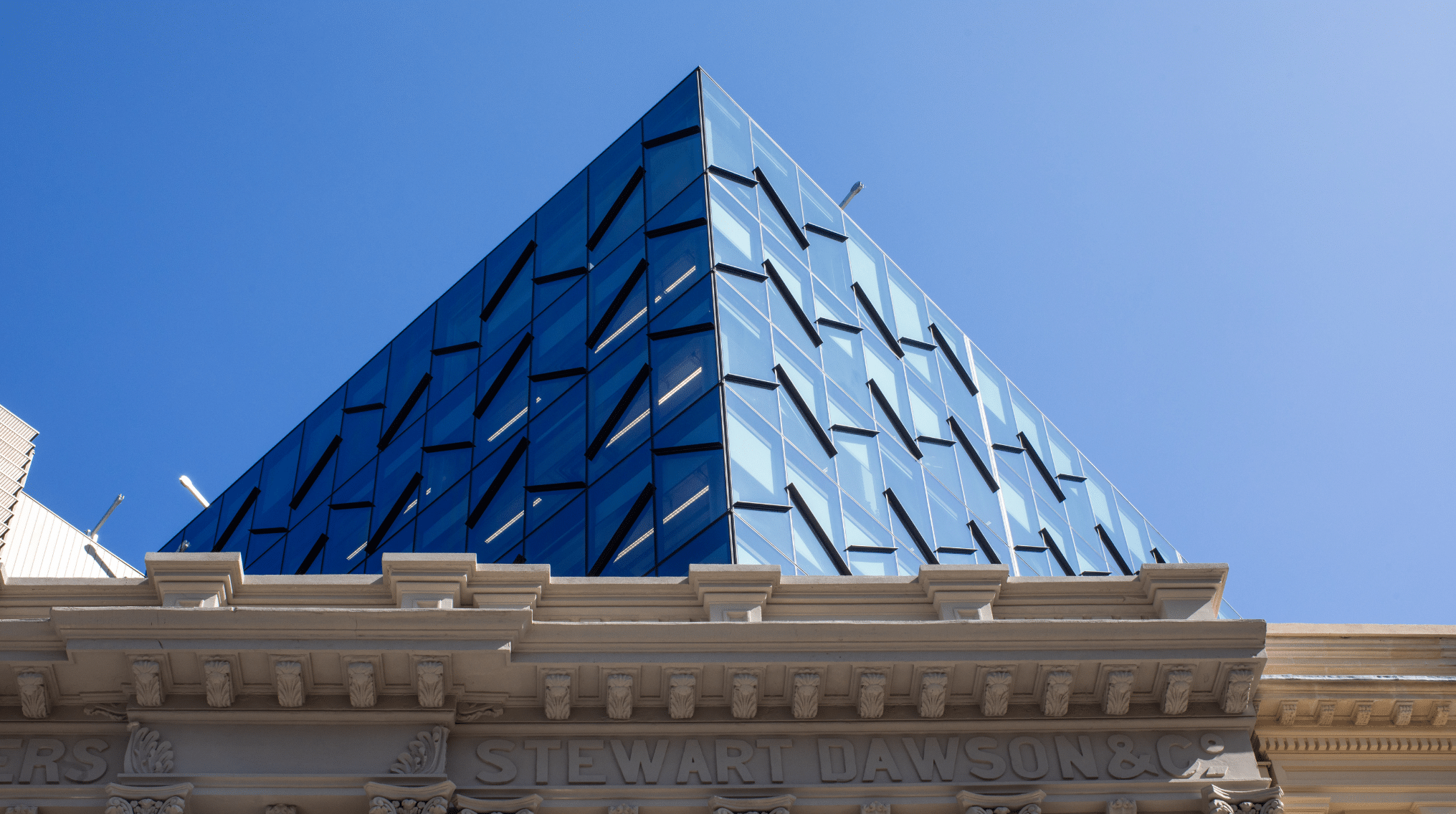

Flagship developments are beginning to shape the future of our city centres, catering to shifting occupier expectations around quality, location, and sustainability.

For investors and developers, the message is clear: premium assets in prime locations are best positioned to capture demand in a competitive market.