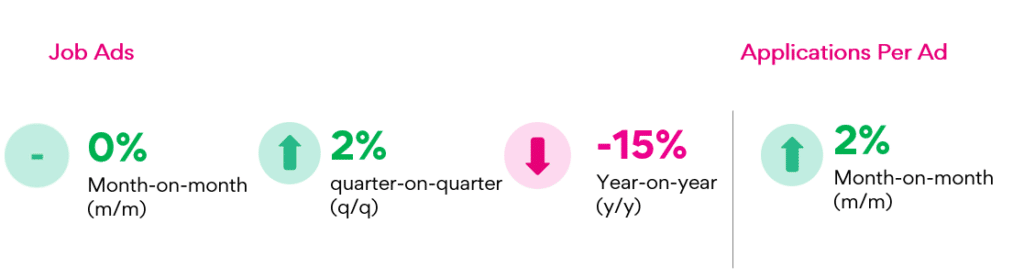

The March SEEK NZ Employment Report has revealed the first quarterly rise in national job ad volumes in over two and a half years — a positive signal for New Zealand’s construction and property industries after a prolonged period of market contraction.

While year-on-year figures still show a 15% decline in overall job ads, this latest quarter’s 2% growth suggests that hiring activity may be stabilising. Particularly encouraging for industry leaders is the upward trend in regional areas and within key sectors linked to development and infrastructure.

Figure 1: National SEEK job ad percentage change m/m (March 2024 to March 2025).

Construction Sector Holds Ground in the Regions

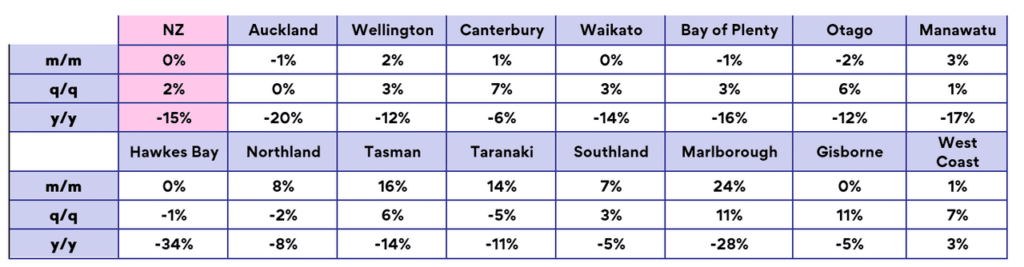

Job ad growth in the construction sector — although modest — was largely driven by activity outside of the main metropolitan hubs. This regional resilience offset broader declines in metro-based industrial and consumer sectors.

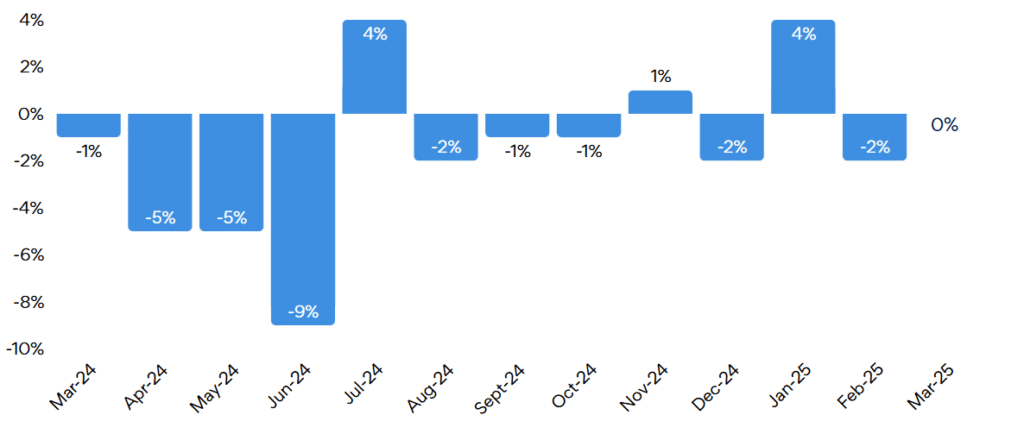

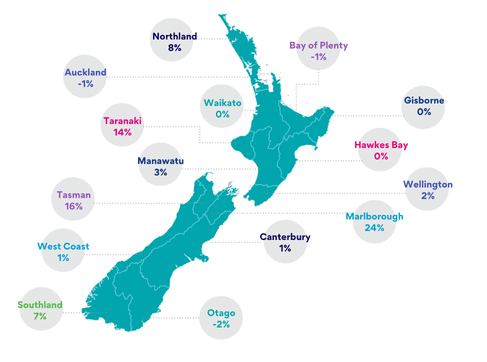

Table 1: National and regional job ad growth/decline comparing: i) m/m, ii) q/q and iii) y/y

Canterbury and Otago stood out among the major regions, recording quarterly job ad growth of 7% and 6% respectively, with Canterbury also posting a 1% lift month-on-month. These figures are significant given both regions’ ongoing infrastructure and development projects, particularly in Christchurch’s rebuild and Queenstown’s booming housing demand.

In the smaller regions, strong month-on-month gains in Marlborough (24%), Tasman (16%), and Taranaki (14%) hint at a potential upswing in localised construction activity, perhaps linked to government-led infrastructure investments and smaller-scale private development.

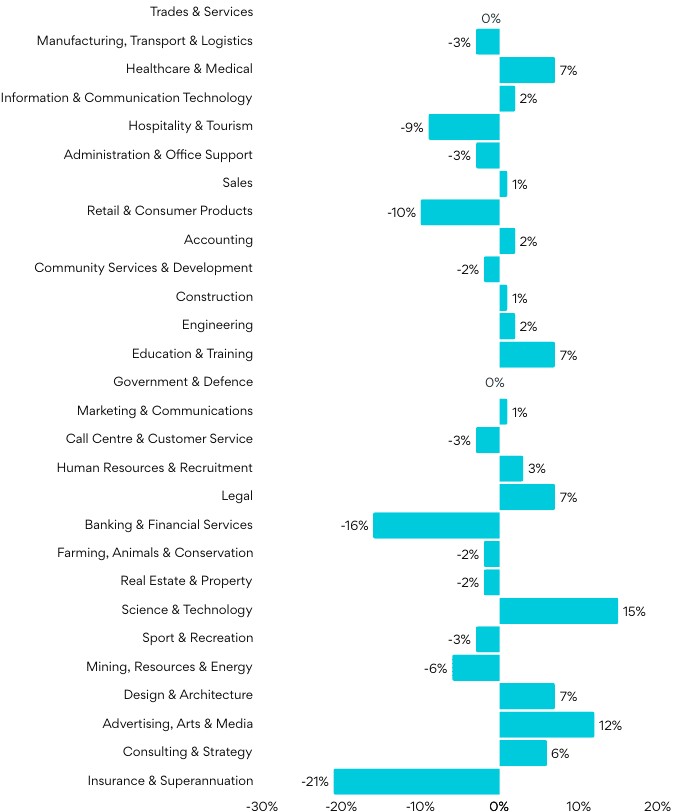

Figure 2: Job ad percentage change by sector March 2025 v February 2025 (m/m)

Labour Market Tight but Competitive

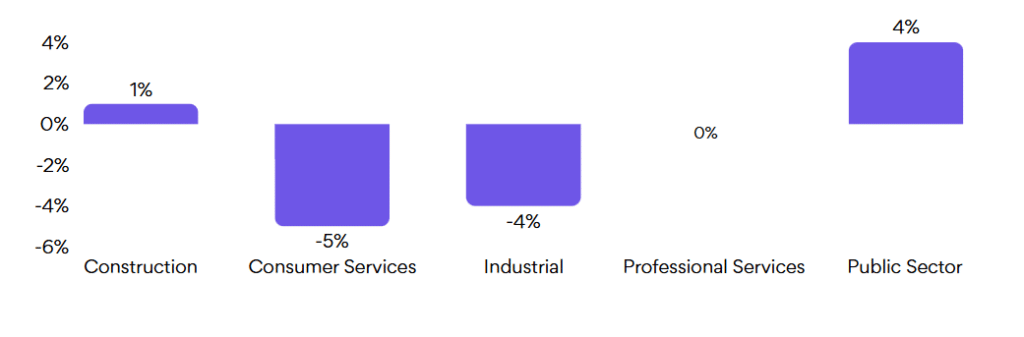

Applications per job ad are on the rise across the board — up 2% nationally in March — suggesting a highly competitive environment for job seekers. While this presents a talent surplus in some areas, it also reflects employers’ cautious approach to hiring amid ongoing global economic uncertainty.

Waikato (8%), Manawatu (7%), and Otago (6%) recorded notable increases in applications per role, adding further evidence that workers are eyeing opportunities in regional areas with active development pipelines.

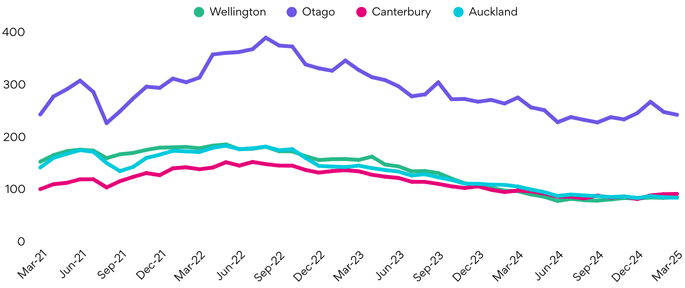

Figure 3: National SEEK job ad percentage change by major region - March 2021 to March 2025.

Figure 4: National SEEK job ad percentage change by region (March 2025 vs February 2025)

Sales and Office Support Roles on the Rise

While the broader consumer-facing sectors like Hospitality and Retail continued to decline, job ads in Administration & Office Support (+4%) and Sales (+4%) saw quarterly gains, likely influenced by activity in commercial real estate and property services.

These roles are often the first to rebound during early recovery phases in property cycles, pointing to potential demand for back-office support in agencies, development firms, and construction businesses ramping up operations.

That said, Real Estate and Property saw a -2% decline in national job ads between February and March, reflecting a slight softening after the “new year, new job” movements that traditionally follow the summer break.

Figure 5: National SEEK Job Ad percentage change by industry (March 2025 vs February 2025) – Ordered by job ad volume

Outlook for Industry Professionals

While it’s too early to call a recovery, the data shows early indications of stabilisation in employment linked to construction, infrastructure, and property services. SEEK NZ Country Manager Rob Clark notes that “there are early signs that economic and labour market growth may be on the horizon,” even as global conditions remain uncertain.

For professionals in construction, real estate, consulting and property development, this report offers a cautiously optimistic outlook. As hiring picks up in regional areas and support roles increase in tandem with property activity, businesses should start preparing for a more active employment landscape through the remainder of 2025 and into 2026.

Regional job growth and increased hiring in property-adjacent roles suggest early signs of recovery for New Zealand’s property and construction sectors. As with any cycle, as talent competition heats up, now is a strategic time for employers to sharpen their recruitment approach.

Read the full report here.